How To Open An Upstox Demat Account

Quick & Secure Onboarding

All data is stored safely with encryption as per regulatory guidelines.

Step 1

Verify KYC & bank details

Step 2

eSign

Step 3

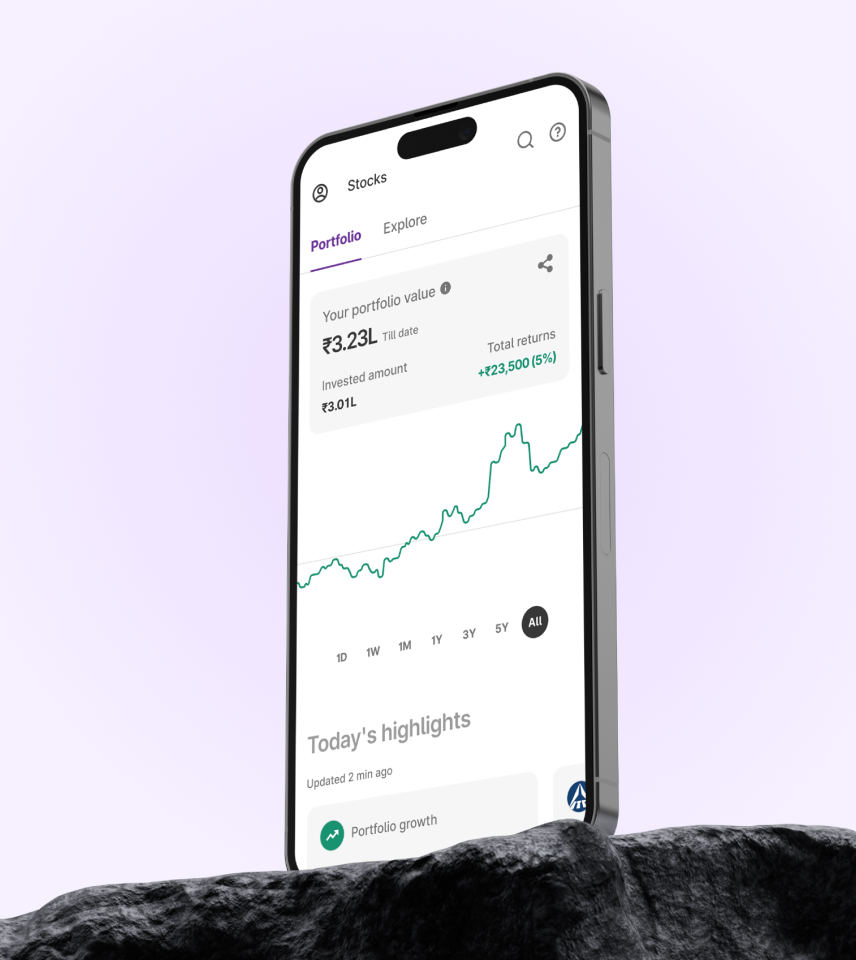

Download the app & start trading

₹0

Account Opening

Demat + Trading

₹0

Commission

Mutual Funds and IPOs

₹0

Demat AMC

Account Maintenance Charges

₹20

Brokerage

Equity, F&O, Commodity and Currency orders

*Zero AMC Is Applicable For Customers Onboarded After August 2021

Awards and Accolades

Go to ‘Account’ → Enable ‘Upstox for Investor’

Most promising broking house of the year

2019

Highest Number Of Accounts in a Single Month by a broker

2019, 2020

Best innovation in wealth management

2020

Highest Number Of Demat Accounts in a Single Month

2021

Demat 101

Everything you need to know about opening a Demat Account

What is a Demat account?

A Demat (short for Dematerialized) is an electronic account used to hold and manage investments like Stocks, Bonds, Mutual Funds in a digital format. Just as you need to have a bank account to deposit your money and earn interest, you need to open a Demat account to buy or sell financial securities such as Stocks, Mutual Funds, Equity Traded Funds (ETFs), SGBs and more. When you buy stocks or shares, they will get credited to your account.

When you sell the stocks or shares you have purchased,

they will get debited from your account.

By opening a Demat account, you do not need to transfer your share certificates physically to the buyer. You need to link your bank account with your Demat account, through which you can easily buy and sell shares. It does not only save your time, but it also reduces the transaction cost.

Benefits of opening a Demat Account on Upstox

There are many benefits of opening a Demat Account on Upstox. Let’s look at a few of them

- Easy TrackingDemat accounts make it easier to track & monitor your investments online

- Reduces RisksNo risk of theft, forgery or misplacing your investments

- Saves TimeLesser time to buy and sell investments online instead of physical transactions

- Saves TimeLesser time to buy and sell investments online instead of physical transactions

Documents Required To Open A Demat Account

Opening a Demat Account requires just 2 documents: PAN + Aadhaar

- If you already have a Demat account with another broker: No need to reupload these documents, they will be fetched automatically from the central KYC agency.

- If you do not have a Demat account with another broker: These documents will be fetched from DigiLocker. For this, Aadhaar needs to be linked with a mobile number.

- Want your Demat account for Futures, Options, Currencies and Commodities?Keep these handy: Salary Slips, Bank Statement or ITR etc.

- Want your Demat account for Futures, Options, Currencies and Commodities?Keep these handy: Salary Slips, Bank Statement or ITR etc.

Charges to Open A Demat Account

Account Opening: There are no charges to open an Upstox Demat account

Account Maintenance Charges: While some brokerages may charge an annual account maintenance charge, there are no annual account maintenance charges at Upstox, you can open and use your Upstox Demat account for free.

Commission: There is zero commission when you invest in Mutual Funds or IPOs.

Brokerage Charges: Up to ₹20 on Equity, Futures, Options, Commodity and currency orders.

By opening a Demat account, you do not need to transfer your share certificates physically to the buyer. You need to link your bank account with your Demat account, through which you can easily buy and sell shares. It does not only save your time, but

By opening a Demat account, you do not need to transfer your share certificates physically to the buyer. You need to link your bank account with your Demat account, through which you can easily buy and sell shares. It does not only save your time, but it also reduces the transaction cost.

Demat Account vs a Trading Account

| Trading | Demat |

|---|---|

| Stores the cash used to buy shares. Any profit and losses from trading reflected here. | Stores the bought shares, bonds, government securities, and Mutual Funds in electronic format |

| Opened via a stockbroker | Opened via a depository participant - CDSL or NSDL |

| Facilitates trading related transactions | Ensures the safety of shares |

Safeguarding Your Demat Account

Your Demat Account holds all your investments and wealth, so safeguarding it is pretty important. Here are a few pointers to ensure your Demat Account is secure and safe:

- Add a Nominee to your Demat AccountA nominee is the person you legally appoint to own your shares in your absence.

- You can add a Nominee by following these stepsHow can I add a new nominee to my account?

- Keep your account details confidentialNever share your Upstox Demat and Trading account passwords/PINs with anyone

- Keep your account details confidentialNever share your Upstox Demat and Trading account passwords/PINs with anyone Update your Upstox App Regularly update your Upstox app for the latest security patches and bug fixes Beware of phishing attempts!Beware of phishing. Upstox will never ask for passwords/ sensitive details via email/messages. Avoid suspicious links and downloadsDon't click on suspicious links or download attachments from unknown sources Secure your devicesProtect your mobiles/computers with a strong passcode/ biometric authentication for added protection Beware of public Wi-FiAvoid using open public Wi-Fi networks when accessing your Upstox app Monitor your account activityIf you observe any suspicious activity, report to Upstox immediately

What is a Demat Account Number?

The Demat Account Number is a 16-digit number. Eg: 12081800 00123456. The first 8-digits of this number are the DP ID and the last 8-digits are the Client ID. You'll also get your DP ID when your account is opened with Upstox.

How to check my Demat Account Number?

Here are steps to check your Demat account number on Upstox:

- Step 1: Login to the Upstox app using your 6-digit PIN or Biometrics.

- Step 2: Click on ‘Account’ at the bottom of the screen.

- Step 3: Click on ‘My Account’.

- Step 4: Click on ‘Profile’.

- Step 5: Click ‘My trading plan’ under ‘Profile’. You will be redirected to the ‘Trading Plan’ page.

- Step 5: Click ‘My trading plan’ under ‘Profile’. You will be redirected to the ‘Trading Plan’ page.

- Step 6: Here, you will find the 16 digit Demat account number and your plan details.

Linking Another Demat Account On Upstox

If you wish to transfer shares from your other CDSL/NSDL Demat Account to Upstox Demat Account, you will need to submit a DIS (delivery instruction slip) to your existing broker. It must be duly filled out and signed by all account holders. Details to be furnished in the Delivery Instruction Slip (DIS):

- Depository: CDSL

- DP Name: Upstox Securities Pvt. Ltd

- Demat Id: ______________ (12081800 / 12081801)

- Demat Account number (8 digit number): ___________

- Client/Beneficiary ID (16 digit number): _____________ (Combination of Demat ID and Demat Account number) Security details: Scrip name, ISIN, and Quantity. In case your Broker asks for a Client Master Report (CMR) refer to the below link what-is-cmr-and-how-to-request-for-a-cmr- Note: Transfer of shares takes a minimum of 24 hours to be completed.

What are the Demat and Remat charges?

Demat stands for dematerialization. Dematerialization as the name suggests is the process through which a trader or investor can convert existing physical share certificates into electronic shares. For Dematerialisation, the charges are ₹ 20/- per certificate and an additional charge of ₹ 50/- per request.

Remat stands for rematerialization. Rematerialization is the process through which you, the trader, can get your electronically held securities converted into physical certificates by processing your request via Upstox. The Remat charges are ₹25 for every 100 shares or part thereof. Remat charges are subject to a maximum fee of ₹5,00,000 or a flat fee of ₹25 per certificate, whichever is higher.

Remat stands for rematerialization. Rematerialization is the process through which you, the trader, can get your electronically held securities converted into physical certificates by processing your request via Upstox. The Remat charges are ₹25 for every 100 shares or part thereof. Remat charges are subject to a maximum fee of ₹5,00,000 or a flat fee of ₹25 per certificate, whichever is higher.

2X Margin on 450+ stocks

2X Margin on 450+ stocks Investment ideas on the app

Investment ideas on the app Analyst ratings

Analyst ratings SIP and Mutual Funds

SIP and Mutual Funds